Unveiling Our Passion for Innovation

At CodeFrites, we're not just developers; we're dreamers, creators, and problem solvers. Our journey began with a shared love for transforming ideas into remarkable digital experiences. With a blend of technical expertise and artistic flair, we craft websites that not only meet your needs but exceed your expectations. Every project is an opportunity for us to weave innovation into the fabric of the online world. Join us in embracing the future of web development.

So, Why Choose

Carvel Russ?

Hi there! 👋

Here at CodeFrites, we're not just another web development company. We stand out through our unwavering commitment to excellence and innovation.

When you partner with us, you're not just getting a service; you're getting a transformational experience that will elevate your digital presence.

Ready to elevate your digital presence with CodeFrites? Partner with us for an unmatched transformational experience!

Ready to elevate your digital presence with CodeFrites? Partner with us for an unmatched transformational experience!

Testimonials

What Our Clients Are Saying

Discover the experiences of those who entrusted us with their projects. Read their stories and join the growing list of satisfied clients.

At CodeFrites, our clients' satisfaction is the heart of our success. Discover the experiences of those who entrusted us with their projects. From startups to established businesses, we take pride in delivering exceptional web development solutions that make a difference. Read their stories and join the growing list of satisfied CodeFrites clients.

The team at CodeFrites was attentive to our needs and requirements, and they translated our vision into a stunning website that perfectly represents our brand. They provided regular updates throughout the development process, ensuring we were involved every step of the way.

I really appreciate your efforts in making our agency website so attractive, professional and the way it has been made. Thank you, CodeFrites team for your outstanding work!

We highly recommend CodeFrites to anyone in need of top-quality website development services. Their professionalism, talent, and dedication to customer satisfaction are unparalleled. We look forward to continuing our partnership with you for future projects.

What impressed us the most was their willingness to go the extra mile to make sure we were satisfied with the final product. They patiently addressed all our questions and made adjustments promptly.

Throughout the development process, they were responsive and receptive to our ideas, and their creative input greatly improved the overall functionality of the website. They consistently exceeded our expectations with their attention to detail and innovative solutions.

Since the launch of our online store, we've received numerous compliments from our customers about the website's design and user experience. Our online sales have also seen a significant increase, and we owe it all to the outstanding work done by CodeFrites.

The team at CodeFrites took the time to understand our business needs and target audience, which resulted in a website design that perfectly reflects our brand identity. The user interface is intuitive!

What impressed us the most was their dedication to meeting deadlines without compromising the quality of the work. Our client's website was launched on time, and they provided comprehensive support.

Ready to Transform Your Online Presence?

Experience the difference with CodeFrites. Whether you're a startup, small business, or enterprise, we're here to bring your digital vision to life. Let's collaborate to create a website that not only impresses but also delivers results. Your success story starts with us.

Ready to Transform Your Online Presence?

Experience the difference with CodeFrites. Whether you're a startup, small business, or enterprise, we're here to bring your digital vision to life. Let's collaborate to create a website that not only impresses but also delivers results. Your success story starts with us.

Our Comprehensive Services

Code Frites offers a wide range of services designed to elevate your online presence. Our team of skilled professionals is dedicated to delivering tailored solutions that align with your unique goals. From captivating designs to seamless functionality, we're here to bring your vision to life.

Tech Stacks

These technologies collectively empower CodeFrites to deliver visually appealing, responsive, and feature-rich web applications that meet the modern web standards and user expectations.

Built with latest Bootstrap

Bootstrap is a popular front-end framework that simplifies the process of designing and styling web applications. It provides a collection of responsive CSS and JavaScript components, making it easier to create visually appealing and mobile-friendly websites.

Easy to Customize with Sass

Sass, or Syntactically Awesome Stylesheets, is a preprocessor scripting language that enhances the capabilities of CSS. It allows for the use of variables, nesting, and functions, making CSS more maintainable and efficient.

Kick-start your development

Gulp is a build automation tool that streamlines repetitive tasks in web development. It automates tasks such as minification, compilation, and optimization of CSS, JavaScript, and other assets, saving time and improving workflow efficiency.

Pug - Node templating engine

Pug (formerly known as Jade) is a templating engine for HTML. It simplifies HTML markup with a concise and clean syntax, making it easier to maintain and generate dynamic content in web applications.

Future-proof JavaScript

JavaScript is a versatile programming language used to add interactivity and functionality to web applications. It enables client-side scripting and interaction with web page elements, enhancing the user experience.

W3C valid HTML code

HTML, or Hypertext Markup Language, is the backbone of web development. It defines the structure of web pages and is essential for creating the content and layout of websites.

Touch-enabled sliders

Touch-enabled sliders are interactive UI components that allow users to slide or swipe through content, such as images or product listings, on touch-screen devices. They enhance the user experience on mobile and tablet devices.

Google fonts

Google Fonts is a library of free and open-source web fonts provided by Google. It offers a wide variety of fonts that can be easily integrated into web projects to enhance typography and design.

Vector based HD ready icons

Vector-based HD ready icons are scalable, high-quality icons created in vector formats like SVG. They ensure that icons look crisp and clear on high-definition displays, providing a visually pleasing experience for users.

Unlock Digital Success with Integrated Tools for Your Website

At CodeFrites, we're all about empowering your online presence. We integrate essential tools like Google Analytics, Facebook Pixel, and more to supercharge your website's performance. Let's transform your website into a data-driven marketing powerhouse. Contact us today!

Lorem magnis pretium sed curabitur nunc facilisi nunc cursus sagittis volutpat.

In eget a mauris quis. Tortor dui tempus quis integer est sit natoque placerat dolor.

Donec blandit nulla elementum eu. Est dui nibh eget amet curabitur nunc.

Rutrum interdum tortor, sed at nulla. A cursus bibendum elit purus cras praesent.

Congue pellentesque amet, viverra curabitur quam diam scelerisque fermentum urna.

Turpis fermentum, volutpat ultrices sed ultrices proin risus bibendum elit purus.

Ut in turpis consequat odio diam lectus elementum. Est faucibus blandit platea.

Arcu, lorem facilisis nunc tellus, molestie urna nam mi, ullamcorper tempus quis.

F.A.Q

Your Questions, Answered

We understand that choosing a web development partner is a significant decision. Here are answers to some of the questions we frequently encounter. If you have any more inquiries, don't hesitate to reach out to us.

We specialize in website development, including design, coding, and functionality.

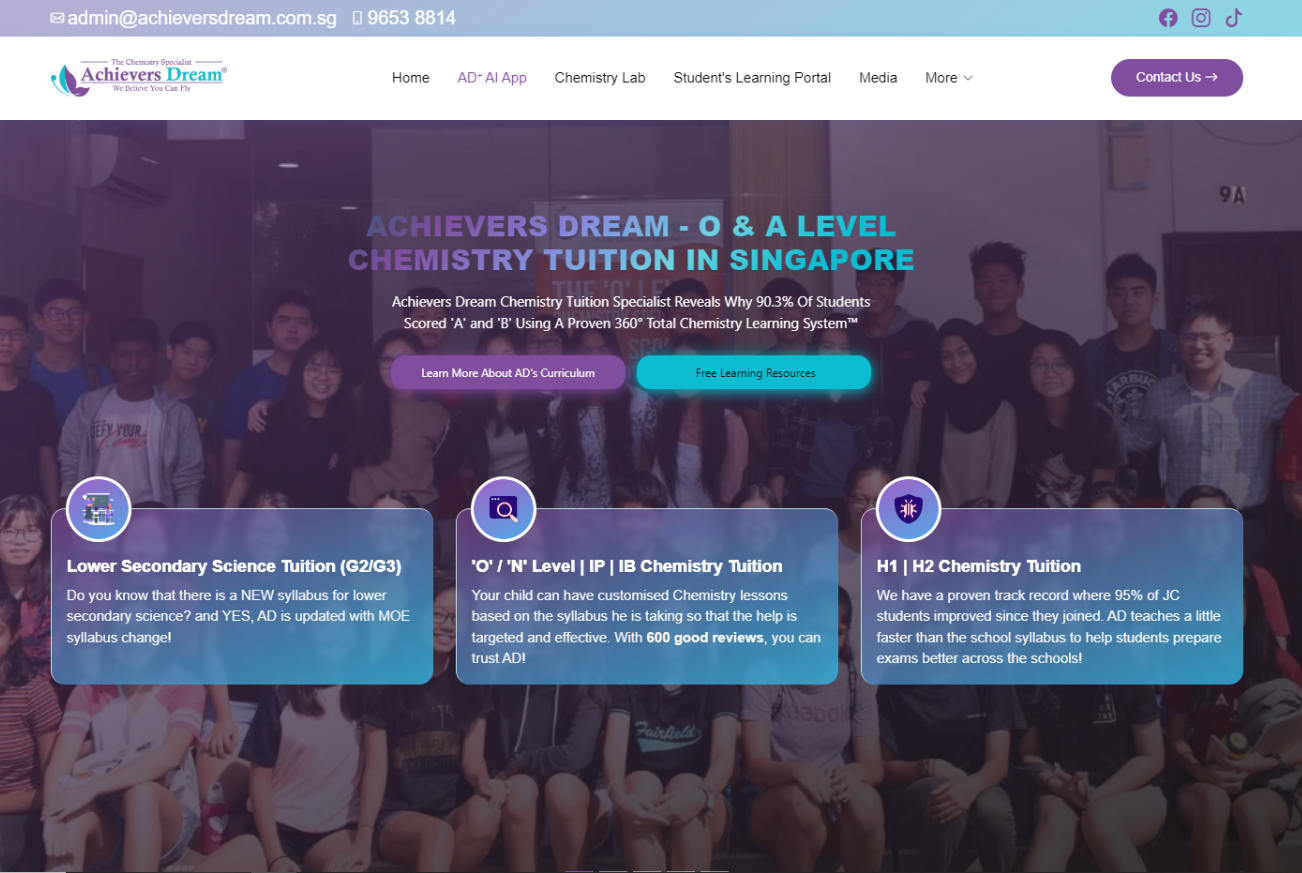

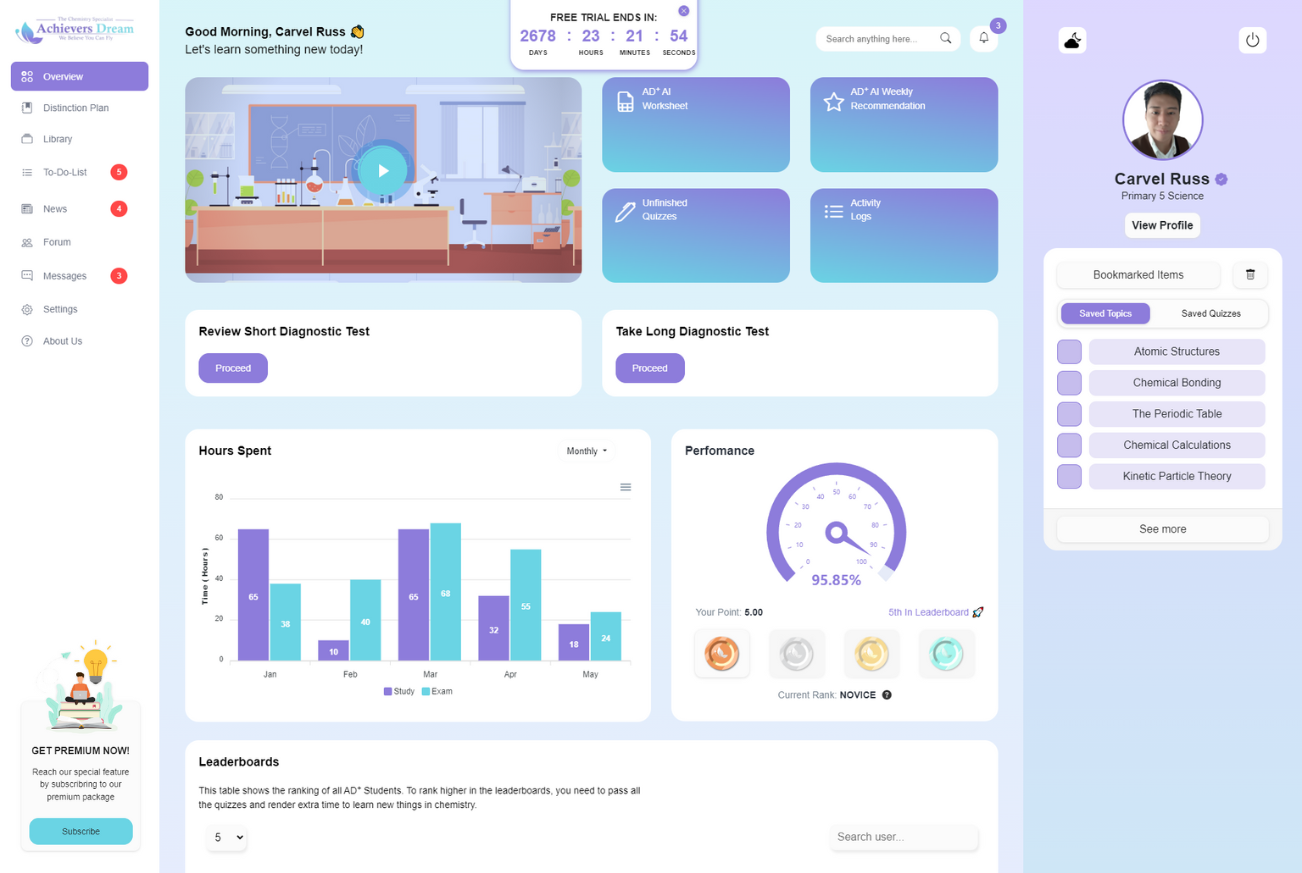

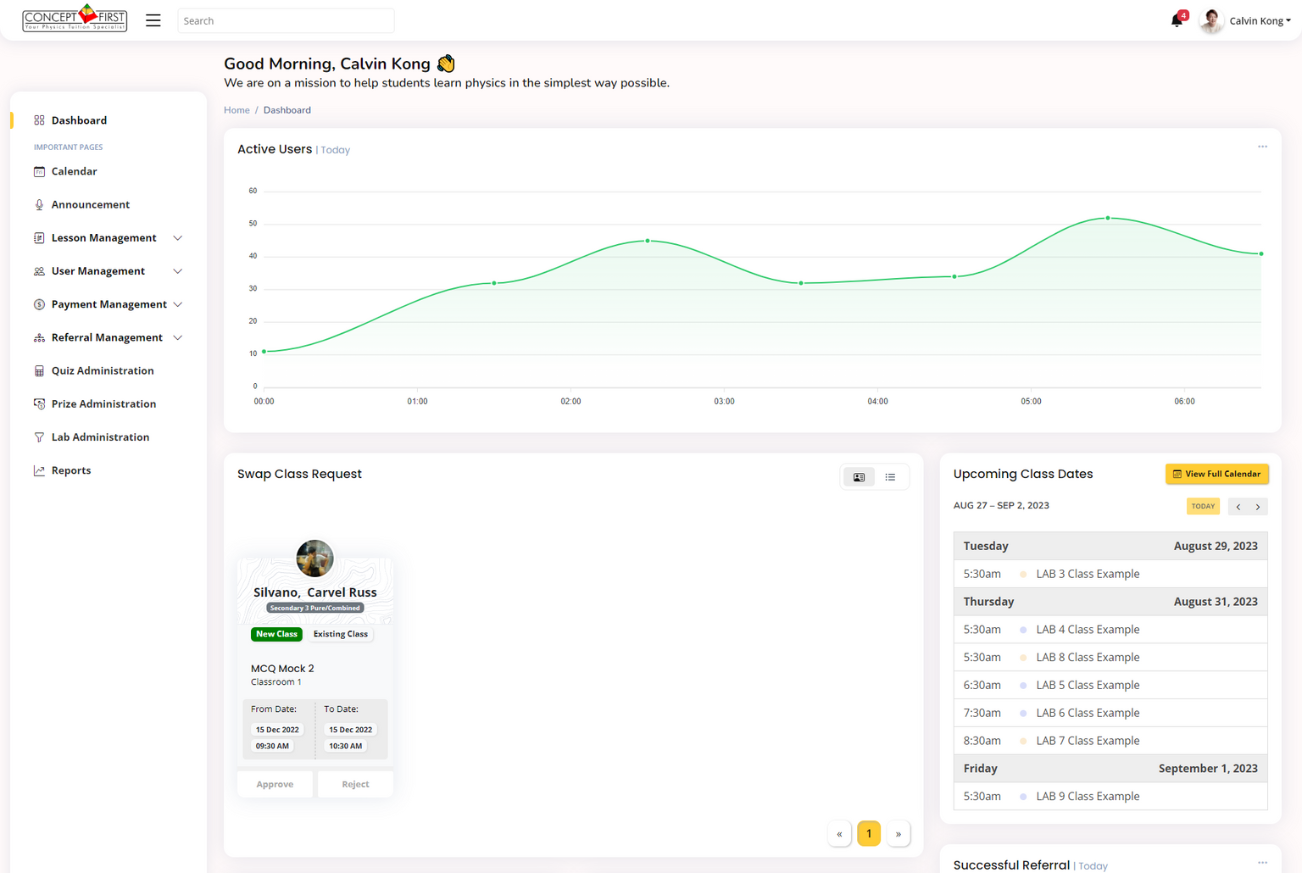

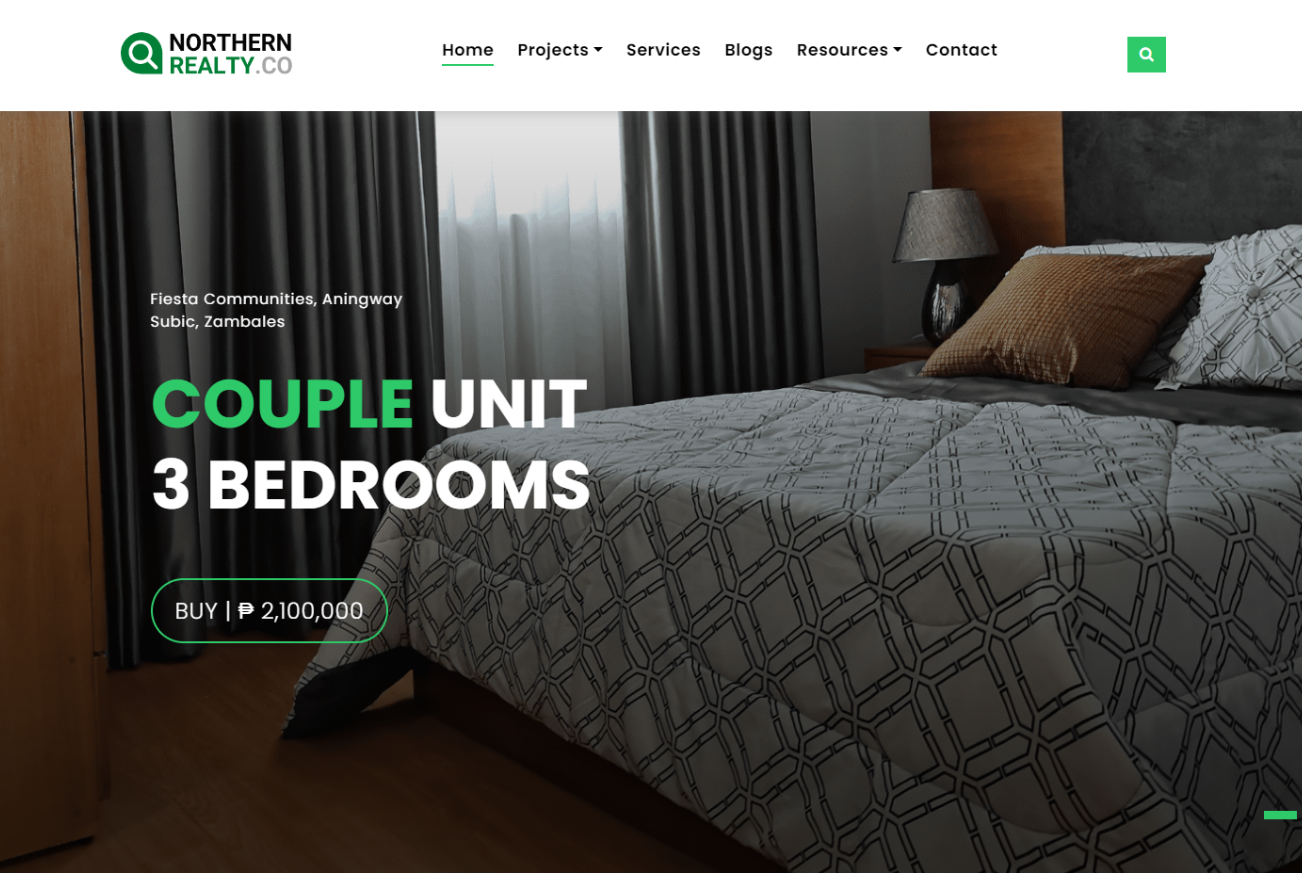

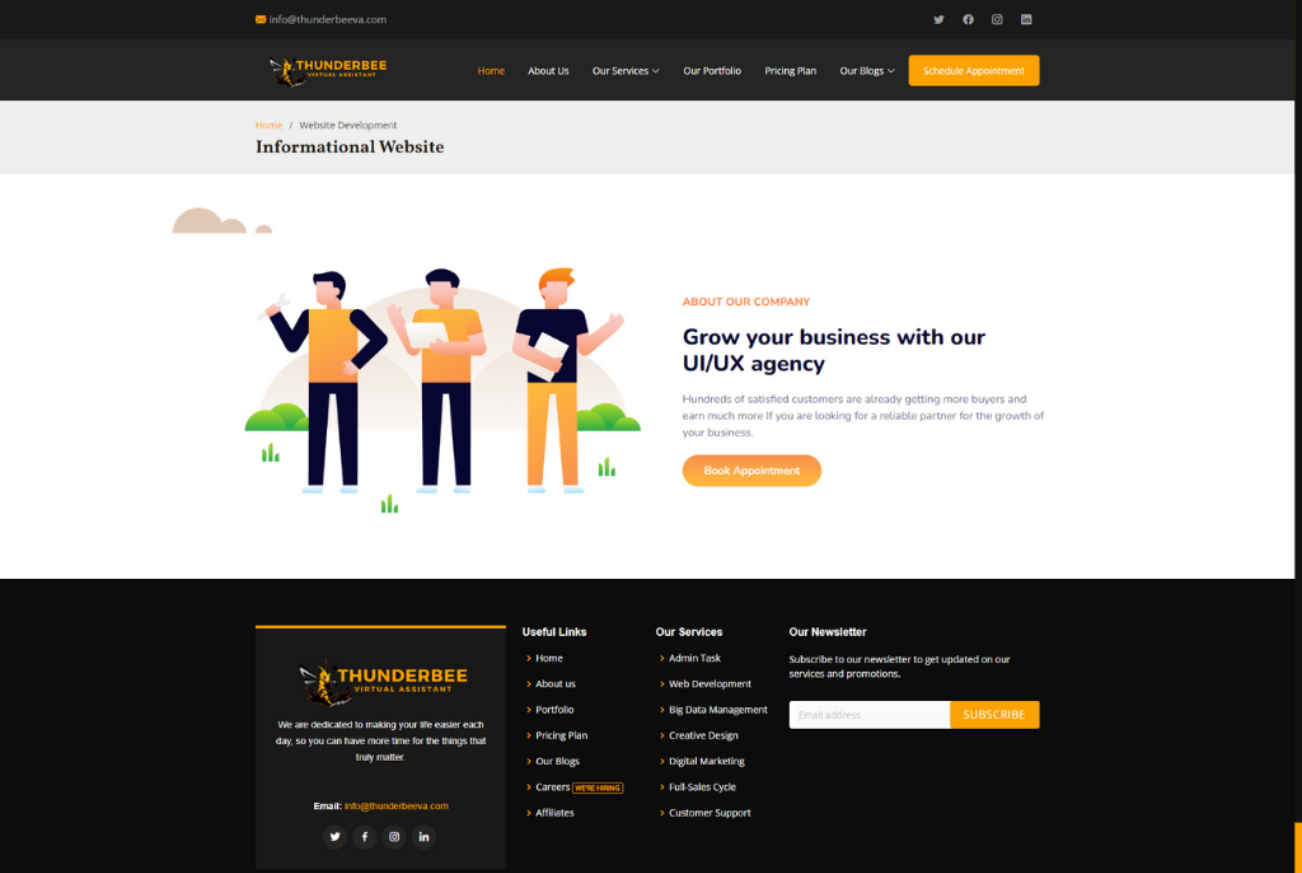

Portfolio

Explore Our Portfolio

Dive into our showcase of projects that exemplify our commitment to creativity and excellence. Discover how we turn ideas into impactful digital solutions.

- All

- Web App

- Web

Let's Elevate Your Digital Journey

At CodeFrites, we're committed to turning your ideas into extraordinary digital experiences. Whether you're launching a new project or looking to revamp your existing website, our team is ready to collaborate and bring your vision to life. Let's embark on this journey together and create a digital masterpiece that leaves a lasting impression.

Happy Clients

Projects

Hours Of Support

Hard Workers

Team

Our Hardworking Team

Ut possimus qui ut temporibus culpa velit eveniet modi omnis est adipisci expedita at voluptas atque vitae autem.

Walter White

Chief Executive Officer

Sarah Jhonson

Product Manager

William Anderson

CTO

Amanda Jepson

AccountantPricing

Check our Pricing

Ut possimus qui ut temporibus culpa velit eveniet modi omnis est adipisci expedita at voluptas atque vitae autem.

Free

$0 / month

- Aida dere

- Nec feugiat nisl

- Nulla at volutpat dola

- Pharetra massa

- Massa ultricies mi

Business

$19 / month

- Aida dere

- Nec feugiat nisl

- Nulla at volutpat dola

- Pharetra massa

- Massa ultricies mi

Developer

$29 / month

- Aida dere

- Nec feugiat nisl

- Nulla at volutpat dola

- Pharetra massa

- Massa ultricies mi

Ultimate

$49 / month

- Aida dere

- Nec feugiat nisl

- Nulla at volutpat dola

- Pharetra massa

- Massa ultricies mi

Contact

Contact Us

Ut possimus qui ut temporibus culpa velit eveniet modi omnis est adipisci expedita at voluptas atque vitae autem.

Our Address

A108 Adam Street, New York, NY 535022

Email Us

Call Us

+1 5589 55488 55

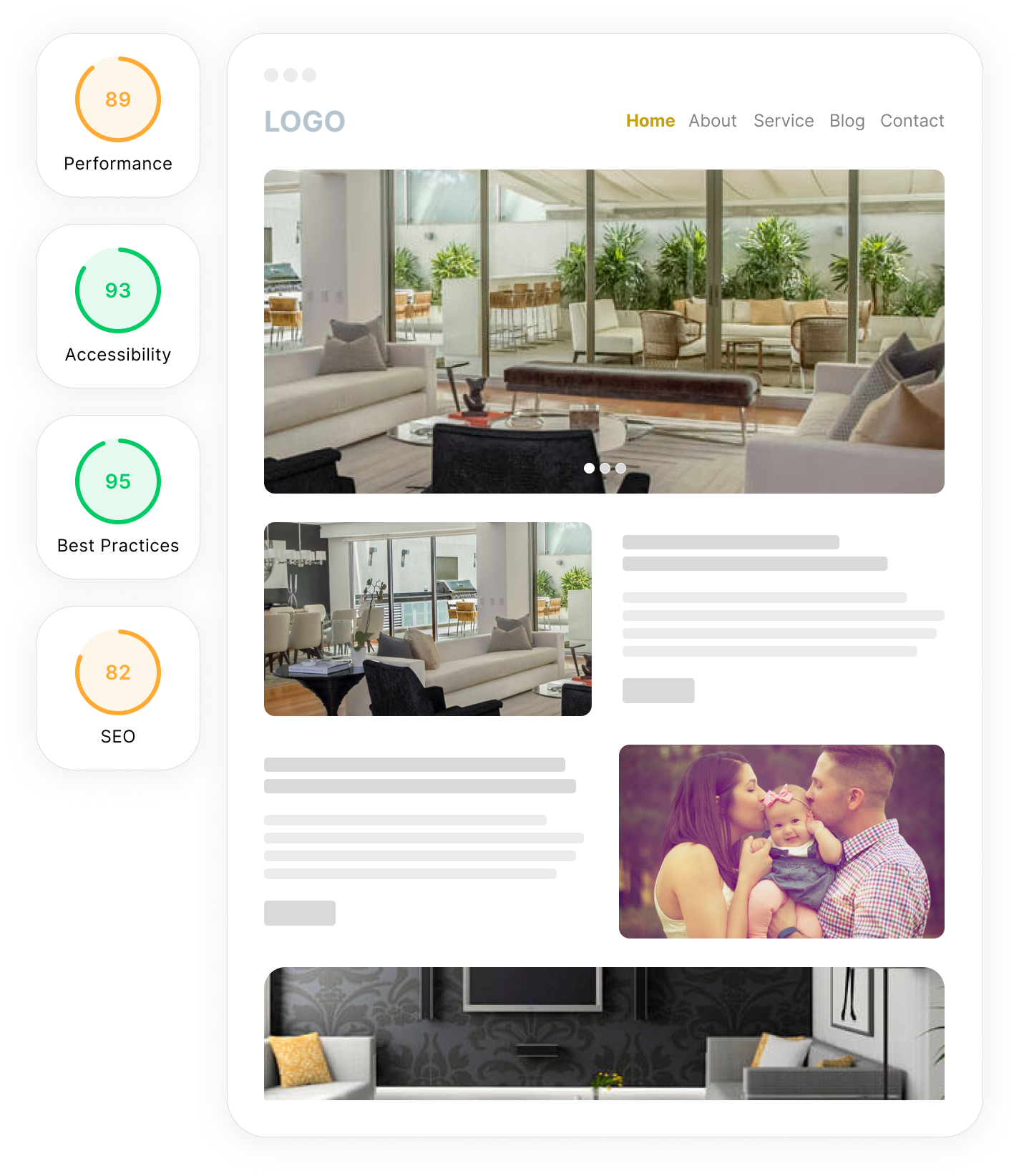

PageSpeed Insights